More and more "Generation Z" professionals (born between 1996 and 2015) are open to sharing data from their smart-home devices with insurers in exchange for a better customer experience or discounts.

So says research by consulting firm Capco among 14,000 consumers in 13 markets worldwide. The researchers gauged respondents' opinions regarding consumer insurance and products. Half of 18- to 24-year-olds and 25- to 34-year-olds said they would be willing to share data from their "smart" home devices with their insurer. In return, insurers are able to offer more personalization in their services to consumers.

Generation Z consumers in particular prefer the use of technology and apps. Two-thirds of them would like to use an app that offers personalized insights and a better view of their financial products such as bank accounts, retirement plans and insurance policies.

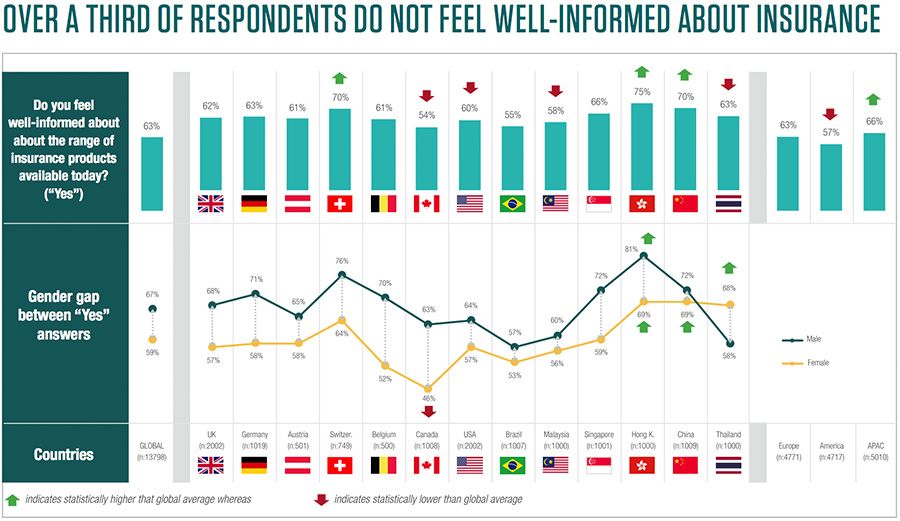

Capco partner Ernst Renner explains that consumers do not want to provide information only to have to wait for a decision from the insurer. "Nor do they want to leave their number, for example, only to be called back later by an employee. What they do want are immediate answers, with the result that insurers' online systems (websites or apps) and call center staff must have the information needed to respond immediately."

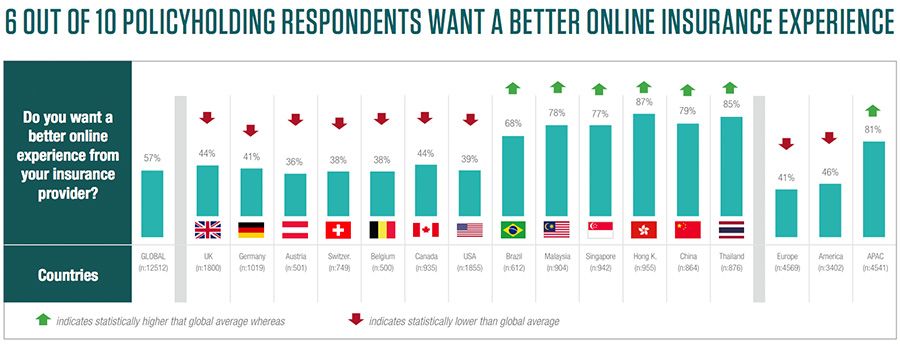

According to Renner, the corona crisis has prompted many insurers to make progress in how they interact digitally with their customers. "Nevertheless, our research shows that there is still plenty of work to be done."

When it comes to buying their insurance, respondents see "value for money" as the most important factor in their decision-making. This is true for respondents of every generation, gender, industry knowledge level and educational background.

Also, most policyholders indicate that their level of confidence and concern about their insurance has not changed despite the pandemic. Still, four in 10 of those surveyed indicate that they have doubts about their level of insurance protection during this time of crisis.

In the research report, Capco further states that digitalization, hyper-personalization and value-for-money are the top priorities for the insurance industry.