On November 29, the Human Rights in Finance.EU Foundation (HRIF.EU) sent a letter with a vision statement to informateur Van Haersma Buma, containing a clear message to the incoming cabinet: recognize the geopolitical reality, establish a sovereign government treasurer. In doing so, place greater emphasis on the protection of citizens' fundamental rights by the government. Break with the old ways of ineffective mass monitoring, the hunt for unusual behavior, the exclusion of customers, and unjustified discrimination.

The foundation, established by experienced professionals from the financial sector, warns that the approach to money laundering in the Netherlands has gone too far andis leading tostructural human rights violations. "Current supervision and policy are too dependent on commercial banks and exclude large groups of people from society," says chairman Simon Lelieveldt. "Cash is being treated with suspicion, payment accounts are being refused, and privacy rights are being violated on a daily basis—all in the name of security."

HRIF.EU previously submitted a petition to parliament in 2024 calling for the pilot monitoring program to be stopped, for the right to a payment account to be enshrined in law, and for a swift transition to a reporting obligation for suspicious transactions only. At the time, politicians did not take much action on this.

In the meantime, however,HRIF hassucceeded in stopping the dragnet of banks, Transactie Monitoring NL, andalso explains in the letter to the formateurs that parliament has not been fully informed. That 'pilot' was not a pilot at all: for years, billions of pieces of sensitive personal data, including data from private individuals, were stored in the database. The unlawful monitoring that is still taking place at banks also qualifies as a major violation of fundamental rights.

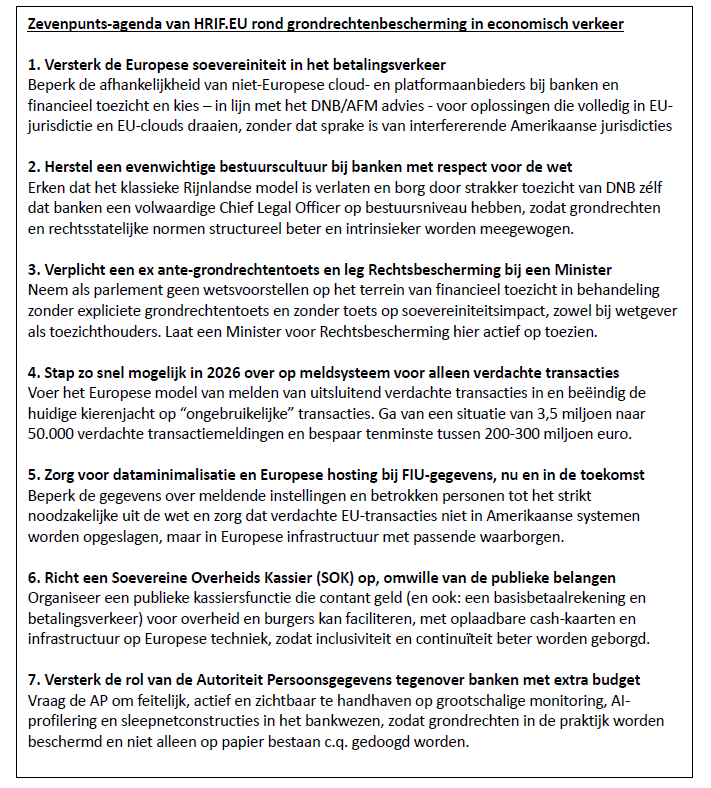

In theappendix to the letter, HRIF.EU presents a positive, actionable agenda for the new cabinet. The seven recommendations are:

An urgent problem that is central to this agenda is the increasing exclusion of citizens who depend on cash. Retailers are burdened with risks and regulations, while citizens without a bank card find it increasingly difficult to participate in society. In practice, obtaining and maintaining a basic payment account also proves problematic for many people, including undocumented migrants, homeless people, and victims of fraud.

HRIF.EU therefore advocates a public solution: the government itself must facilitate basic payment services, rather than shifting this responsibility to banks. With a SOK (Sovereign Government Cashier), rechargeable cash cards, cash-to-bank transfer points, and secure, accessible payment solutions can be realized—particularly at municipalities and government agencies. This prevents commercial parties from being overburdened and guarantees that payment in the Netherlands remains a right, not a privilege.

The current zeitgeist—with geopolitical instability, growing digital dependence on big tech companies, and social inequality—calls for a fundamental rethinking of financial supervision and payment transactions.

Lelieveldt: "For years, we have outsourced everything to the market, but the balance has been lost. It is time to give public infrastructure and the protection of fundamental rights back the place they deserve. It is time for the government to take a step forward in this regard. HRIF.EU shows how this could be done."

Read theletter and the seven-point agendaof Human Rights in Finance (EU) here.